How To Choose An Appropriate Lender

Here's How To Really Choose An Appropriate Lender

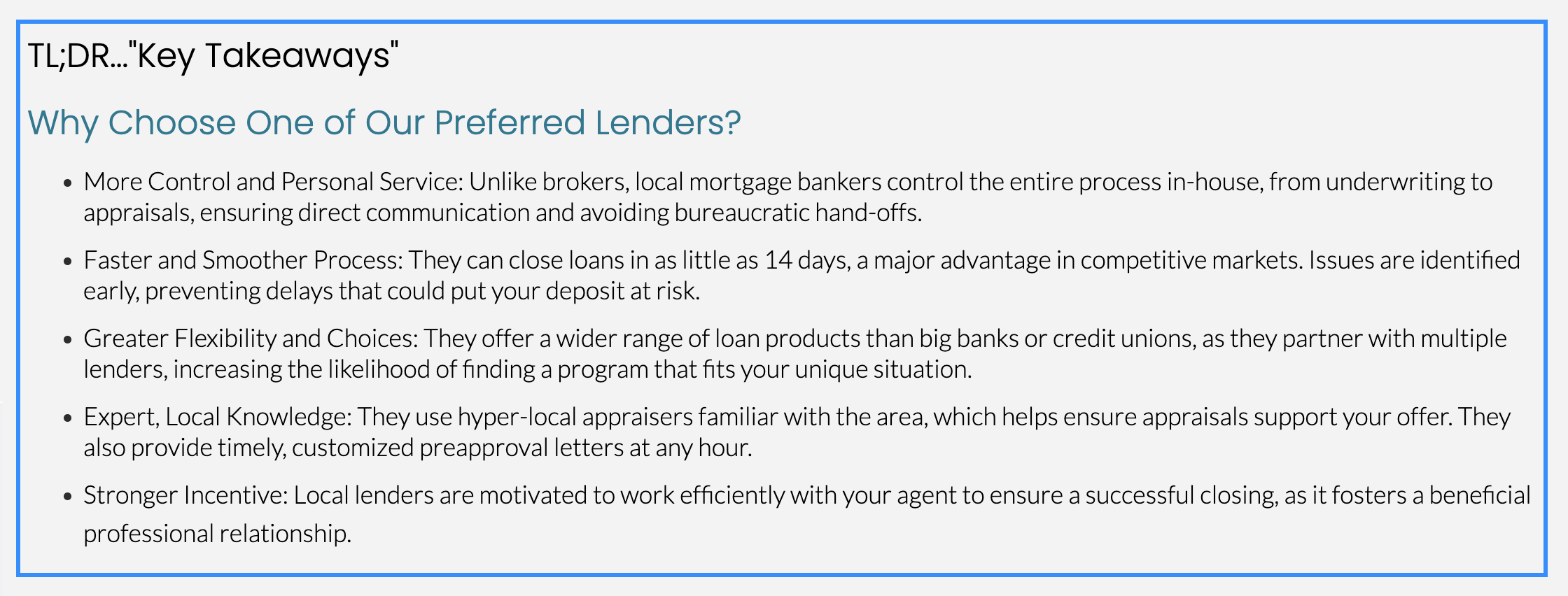

More Control

More Control

Mortgage brokers send your loan file to a big bank or institutional investor. In so doing, they completely lose control over the process & become an intermediary, slowing down communications & abdicating to that lender’s underwriting & appraisal procedures. Our direct lenders are in control of the entire process & work closely with their in-house underwriters & appraisal management company. You will have a direct line of communication.

More Choices

Big banks & CU’s can only offer their own proprietary products, so the bank’s loan officer has no other choices or options. Mortgage bankers & direct lenders have multiple banking relationships ranging from small local lenders all the way up to large multi-national corporations. Therefore, the lenders we use have access to the largest selection of mortgage programs out there & will be much more likely to find one that fits you & your unique situation, often at lower cost to you.

Greater Incentive

Mortgage brokers you or your family have used in the past, especially if located outside your purchase area, are not incentivized to work hard for a Realtor® they don’t know & from whom they will never get referral business. On the other hand, when you work with a Realtor®/Lender team both professionals are strongly motivated to get the job done quickly & efficiently.

Consistent Service

Consistent Service

Our lenders are required by law to pass financial & personal background checks as well as licensing examinations. They are required to complete annual professional development education courses. Employees of large banks work under no such requirements & in fact are often transferred out of your transaction mid-stream, leaving your file in the hands of someone unfamiliar with all that has transpired to-date. This often results in requests for documentation you have already provided but which has now become “stale.” Very frustrating!

Smoother Process

If a big bank’s back room underwriters say, “no” to you (& that usually won’t happen until you are weeks into the process & often does happen even though you were pre-approved), you have to start over from square one with someone else, resubmitting ALL your documentation & applying for a loan all over again. This will put your deposit at risk. You could lose tens of thousands of dollars. With a mortgage banker, your information & documentation is submitted only once and if there is a problem with your file, we’ll know about it much sooner.

Expert Service

Experience matters! Our lenders have been originating mortgages for over 15 years & their companies have been in business for over 25 years. So while they might be small compared to the big banks, they are established, stable, & focused on servicing their customers, not “selling” them.

Better Appraisals

Our lenders use only hyper-local appraisers who are much more likely to rely on appropriate comparable sales data & issue appraisals that support your offer. Big banks & CU’s (whether you go to them directly or via a mortgage broker) hire underpaid, over-worked, high-volume, less experienced appraisers who are not as familiar with our unique East Bay micro-neighborhoods & often pull inappropriate comps, scuttling many a deal. This is one of the most important distinctions & if nothing else convinces you, this point certainly should.

Faster Process

A good loan officer often makes the difference between a deal that closes on time vs. one that falls apart. My lenders can close in as little 14 days! The big banks & especially the credit unions can & will take much longer (30-45 days), even though they’ll promise otherwise. This is a very important difference. When we write an offer for you on a property you want to purchase, we’ll be much more likely to have our offer accepted by the seller who is always interested in a quick close.

Personal Service

Personal Service

A mortgage banker is in greater control of the process from application to funding than is a mortgage broker or a loan officer from a big bank or CU. A mortgage banker personally knows & works hand-in-hand with his or her processors & underwriters, often working from desks in the same room. The file does not get handed off from department to department. Also, a mortgage banker often knows the funders personally & maintains a friendly, trusting, professional relationship with them

Appropriate Loan Locking

Our lenders will not automatically lock your loan rate upon receipt of your ratified purchase contract as will other lenders, but will watch the bond market & corporate bulletins to advise you on the best time to lock. This can save you thousands & thousands of dollars.

Direct Service

You will always communicate directly with the individual to whom we am referring you. You will not be working with a huge, segmented, bureaucratic company that will hand you off from one person to the next so you’ll never become a faceless file or an impersonal number. Our preferred lender will be there for you from start to finish.

Timely Preapproval Letters

Our lending partners will provide me with a customized preapproval letter for the particular property of interest & at the specific offer price we’ve chosen & will do so right away at practically any time. Loan Officers from the big banks & credit unions work banker’s hours, of course, & may not be available when we need them. This could easily cost you the house you want to buy. Our lenders will place a call & a follow-up email to the listing agent “selling” you as a highly qualified borrower who has selected a lender that can & will close on time.

Got more questions? We’ve got more answers!

Want to do an even deeper dive?

Here’s an article from NAR (National Association of REALTORS) – Questions to Ask When Choosing a Lender.

Consistent Service

Consistent Service Personal Service

Personal Service